Social security tax calculator 2021

Although the Quick Calculator makes an initial assumption about your past earnings you will have the. For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400.

Pin On Form W 8 Ben E

Ad Get your benefit verification letter online with a my Social Security account.

. SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future.

And so are we. The maximum Social Security benefit changes each year. When you purchase life and retirement.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The Online Calculator below allows you to estimate your Social Security benefit.

So benefit estimates made by the Quick Calculator are rough. For 2022 its 4194month for those who retire at. To use the Online Calculator you need to enter all your earnings from your online Social Security.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The tool has features specially tailored to the unique needs of retirees receiving.

Be Sure to Hire Someone You Can Trust with Your Taxes. Ad We Can Help File Your Tax Returns. Between 25000 and 34000 you may have to pay income tax on.

However if youre married and file separately youll likely have to pay taxes on your Social Security income. The 2022 limit for joint filers is 32000. The self-employment tax rate is 153.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. If you received repaid or had tax withheld from any non-social security equivalent benefit NSSEB portion of tier 1 tier 2 vested dual benefits or supplemental annuity benefits during. Must be downloaded and installed on your computer.

The AGI included in Column 1 is already reduced by the Social Security amount half of the benefit in Column 3 must be added back in. What You Need Have this ready. Social Security Taxes are based on employee wages.

Social Security website provides calculators for various purposes. For each age we. The rate consists of two parts.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Yes there is a limit to how much you can receive in Social Security benefits. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which.

This calculator computes federal income. Get the most precise estimate of your retirement disability and survivors benefits. Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited.

The estimate includes WEP reduction. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits.

Enter your expected earnings for 2022. And is based on the tax brackets of 2021. It is mainly intended for residents of the US.

The HI Medicare is rate is set at 145 and has no.

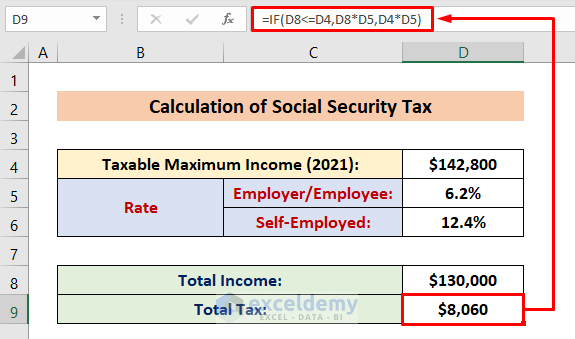

How To Calculate Social Security Tax In Excel Exceldemy

Pin On Retirement

Tax Calculator Estimate Your Income Tax For 2022 Free

Financial Management With Regard To Astm E2659 Financial Management Retirement Savings Plan Profit And Loss Statement

Social Security Benefits Tax Calculator

Social Security Benefits Tax Calculator

Ho9hyilrllpdfm

Easiest 2021 Fica Tax Calculator

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Pin On Spreadsheets

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2021 Business And Life Review Happier Freelancing In 2022 Life Review Budgeting Blogs Life

Resource Taxable Social Security Calculator

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

The 3 Most Surprising Social Security Benefits You Can Get The Motley Fool The Motley Fool Investing Dividend

Best Way To Calculate The Payroll Hours And Minutes Manually My View In 2022 Payroll Payroll Software Hourly Work